Today’s word is “digital”. Digital means many things, of course, but for this “word”, I’ll consider farmer-focused digital tools that enable better practices and decision-making. I’ll touch on digital in a broader concept in the New Year.

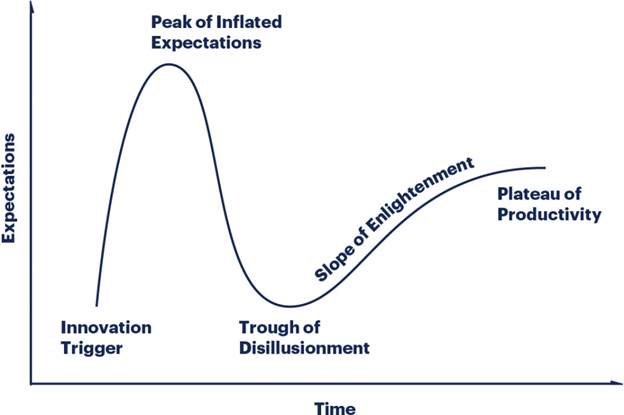

Experienced investors know that new technologies usually move from initial excitement – and often overexuberance – through the trough of despair or disillusionment before emerging as stable technologies in a stable industry segment with a sustainable market impact. With a handful of new technologies and industry segments today continuing to be invested in by various VC and PE firms, we can take stock of where each is on this “hype cycle”.

Source: Gartner Hype Cycle, gartner.com

For some new market segments, their hype cycle stage is obvious. For example, animal protein replacements and controlled environment agriculture (“CEA”) segments have been dropping from the peak of overinflated expectations towards the trough of disillusionment. Specific recent events – stock price declines, market growth stalling, companies struggling or failing even – signal this stage.

Where do we find ourselves today with the farmer software digital segment of our industry? Are there critical signals for our assessment? There has been a lot of “hype” over digital ag, which likely started with Monsanto’s acquisition of Climate Corp for $990M in 2013. Monsanto shared with analysts how, like all businesses, they were evolving to be a data company and that all agriculture would be digitized. This caused a flood of investment, but, like many industries, it failed to deliver on its promises. Why is this? I will discuss this in more detail in the New Year. But since then, we have seen very mixed signals. Most recently, Corteva sold its Granular Business to Traction Ag, a powerful signal of the challenge in deployment and value capture associated with digital tools for farmers. While many of us are convinced there is a tremendous untapped value that can be released through better use of farm-generated data of all types, it hasn’t proven easy to create technology that achieves this in a monetizable way. Apparently, Corteva has concluded that it is better served letting others address this challenge. No doubt they’ve not abandoned digital to serve farmers, just how to realize the value proposition cost-effectively.

In a different step, but with a similar goal, Bayer and Microsoft announced a partnership around a year ago to create an infrastructure to support startups who want to accelerate and simplify their challenge of building digital tools for farmers. And speaking of “infrastructure”, Leaf Ag, where we have invested, has created “digital plumbing” to simplify connectivity across platforms and enable small and large companies to focus on their core business. It has identified a critical pain point for quickly creating platform breadth.

So where are we on the farmer software “hype cycle”? We’ve certainly passed the hype cycle peak, with clear winners emerging.

What does this mean for startups? There remains much room to innovate, but the challenge is less about technology and more about business models. As digital investors, we are far more interested in a good business model that can monetize value created for farmers in the right way. It’s not always the first companies into the market that prevail, as much experience has taught us. Apple didn’t invent MP3 players, but it did revolutionize how we listen to music. This was more in tune with the suitable business model versus a novel technology (e.g. MP3).

What does this mean for investors? With no large company yet having created broad enough platforms with various features to attract a significant market share, large companies today, or large ones that emerge in the next few years, should become acquirers of successful companies. We remain very bullish on this segment at Radicle, and we’re glad we’re past the hype cycle peak!